Budgeting and Money Saving Tips for Students

Unsure of how to manage your money? Here’s a simple guide from undergraduate student Radhika on how to create a budget, including some money saving hacks!

My story

When I first started university, I had no idea about how to manage my money. I didn’t know how much money was coming in through my student loan and job, or how much money was leaving my account from spending. This meant I’d often be shocked after seeing my bank statement at the end of the month. Fast forward to a year later, I’m happy to say I’ve learnt the importance of sticking to a budget and have come up with a simple budgeting method that works for me, so hopefully it’ll help you too!

My 4-step budgeting method

Step 1: Have a separate bank account dedicated to university spending

My main bank account that I use for receiving my student loan and salary is with Nationwide. Unfortunately, most banking apps don’t provide a breakdown of what you’re actually spending money on. After doing some research, I came across a brilliant banking app called Monzo. Monzo is incredibly popular with students as you can create separate ‘pots’ for saving money, and the app notifies you when you’re about to go over budget. I find Monzo helpful because I can compare my spending month by month and it gives me a breakdown of where exactly I’m spending my monthly budget.

Managing money doesn't have to be hard!

Step 2: Calculate how much you receive from your student loan

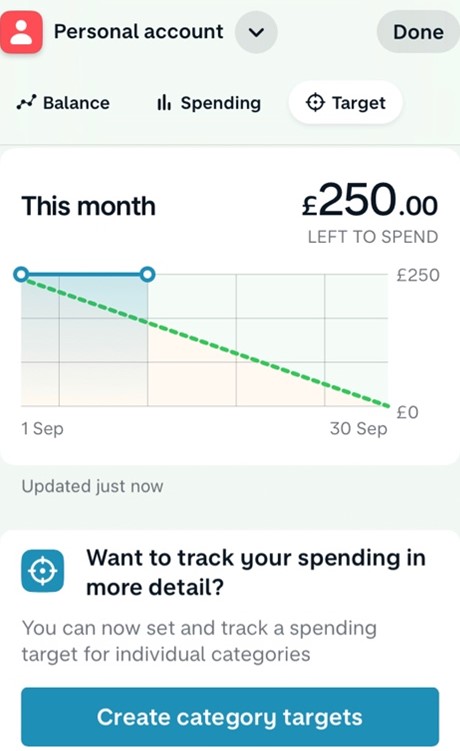

After opening a separate bank account, the next thing I did was work out how much money I was receiving from my maintenance loan, then dividing this month by month. For example, if I receive a maintenance loan payment of £1000 in September, and my next payment is due in January, then from September to December, I can allocate £250 per month until my next payment (this amount doesn’t include money I received from scholarships, salaries, or parents/guardians).

An example of a monthly budget on Monzo

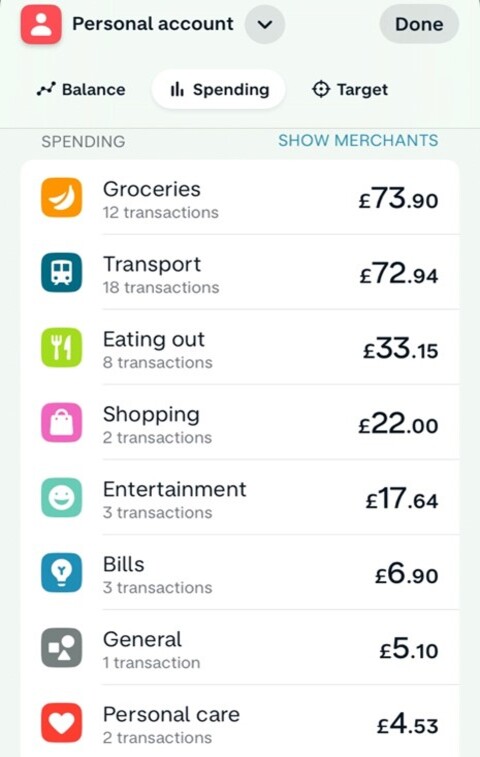

Step 3: Categorise your spending

Once you have a rough idea of how much money you’re spending per month, it’s important to understand where your money is being spent. This is where Monzo really helps because the app automatically sorts out your transactions into categories like transport, entertainment, and groceries. For example, as a local student, I know that each month I spend £56 using Translink public transport. Using spending categories means I can see the areas in which I’m spending, and so I understand the areas where I need to be saving money, to ensure I don’t go over my initial budget.

My monthly spending for February, broken down into simple categories

Step 4: Give yourself a weekly allowance

To take my budget one step further and to limit the risk of spending too much, I further divide my monthly budget by four, to give me a weekly allowance. The rest of that month’s budget is saved into a pot on Monzo titled ‘Next Week’s Money’ meaning it shouldn’t be spent! Using a weekly allowance has helped me become wiser with my purchases, as I have to think twice before tapping my card. At the end of the week, any money left over is then transferred to a Monzo pot labelled ‘Something Good’ and is reserved for treating myself for being a good budgeter!

The remainder of my weekly allowance slowly but surely is building up!

Now that you know how to create a monthly budget, here are five of my money saving tips that every Queen’s student should know!

Money saving tips

- Sign up for a free yLink card to avail of discounted Translink.

- Sign up to UniDays and StudentBeans with your student ID to save money on clothing, food and more!

- If you enjoy drinking with friends, consider opting to drink in the Students’ Union Bar to save money on your night out.

- Share staple food items like pasta, rice and milk with your housemates.

- Always have meals ready to eat in your freezer that just require heating up – these are a life-saver for when you don’t want to cook but also want to save money!

Find out more

More blogs about cost of living advice and tips

Radhika GuptaMedicine | Undergraduate Student | Derry, Northern IrelandHi! My name is Radhika, I’m 19 years old and originally from Derry. I’m currently a second-year medical student and so far, I’ve been loving my course and time in Belfast! I like to spend weekends exploring the city with my friends and trying to find good places to eat/drink. My hobbies include photography, reading and yoga! This year I’m trying to become more involved in university activities, so you may see me around campus as I’m a student ambassador, plus I also love spending time in the Student Union with my friends in the evenings! I’m a member of various medical societies like SWOT and WOMED, and also recreational societies like Chess and Arts! |

|